The SYNTEC agreement includes a minimum wage scale, regularly updated by the social partners.

In agreement no. 47 of March 31, 2022, the social partners negotiated an increase in minimum wages applicable to all companies covered by the SYNTEC agreement.

Rider no. 47 of March 31, 2022 has just been extended by order dated July 18, 2022, published in the JORF on July 22, 2022.

The new grid applies from January 1, 2025.

What is the SYNTEC wage scale?

Certain collective bargaining agreements, including the SYNTEC agreement, lay down specific rules on remuneration, which must be respected.

These grids specify minimum wages to be respected, depending on the employee’s classification.

Employers governed by the SYNTEC agreement must be particularly vigilant, as failure to comply with these minimum standards will entitle employees to claim back pay before the industrial tribunal (Conseil de prud’hommes).

Particular attention should be paid to managerial employees on fixed-day contracts.

Under the SYNTEC Collective Bargaining Agreement, these employees must receive annual remuneration at least equal to 120% of the conventional minimum for position 3.1.

How are employees classified in the SYNTEC wage scale?

The conventional minimum wage applicable to employees will depend on the coefficient and position of each employee, data which must also appear in the employee’s employment contract.

The SYNTEC agreement includes two salary scales, depending on the category of employee:

- A salary scale for employees, technicians and supervisors

- A salary scale for engineers and managers

While the methods used to calculate minimum wages differ according to the two grids (below), certain other characteristics are common to both.

In particular, these grids take into account :

- The employee’s position, i.e. his or her role in the company

- The salary coefficient, a hierarchical indicator that will vary remuneration.

How have the SYNTEC wage scales been modified?

The SYNTEC wage scales had not been modified since 2019.

Rider no. 47 of March 31, 2022 adopted a new wage scale, increasing the minimum wages that employers are obliged to respect.

Under this agreement, the average increases granted are +4.9% for the first level of the ETAM scale and +3.5% for the second level of this scale.

An average increase of +2.5% is granted for the rest of the supervisory and managerial categories.

Please note: This rider has not yet been extended. The new wage scales are therefore not yet applicable. This rider will apply to all companies in the sector in the month following its extension, or the day after its publication in the Journal Officiel, for companies belonging to the SYNTEC-CINOV Federation.

The extension of this rider is scheduled for the 3rd quarter of 2022.

Employers will therefore need to remain particularly vigilant, as once this extension has taken place, the new pay scale will apply to all employees in the branch within a month.

What new salary scales will soon be applicable to companies covered by the SYNTEC agreement?

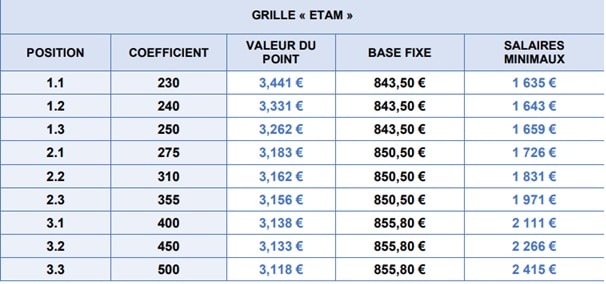

The new salary scale for employees, technicians and supervisors

For the record, the minimum gross monthly salaries applicable to employees in this category are calculated as follows:

Fixed base + (ETAM point value x position coefficient)

In application of this formula, the new gross monthly minimum wages have been set as follows, for the ETAM category:

| Position | Coefficient | Point value (€) | Fixed base (€) | Minimum wage (€) |

|---|---|---|---|---|

| 1.1 | 230 | 3,441 | 843,50 | 1 635 |

| 1.2 | 240 | 3,331 | 843,50 | 1 643 |

| 1.3 | 250 | 3,262 | 843,50 | 1 659 |

| 2.1 | 275 | 3,183 | 850,50 | 1 726 |

| 2.2 | 310 | 3,162 | 850,50 | 1 831 |

| 2.3 | 355 | 3,156 | 850,50 | 1 971 |

| 3.1 | 400 | 3,138 | 855,80 | 2 111 |

| 3.2 | 450 | 3,133 | 855,80 | 2 266 |

| 3.3 | 500 | 3,118 | 855,80 | 2 415 |

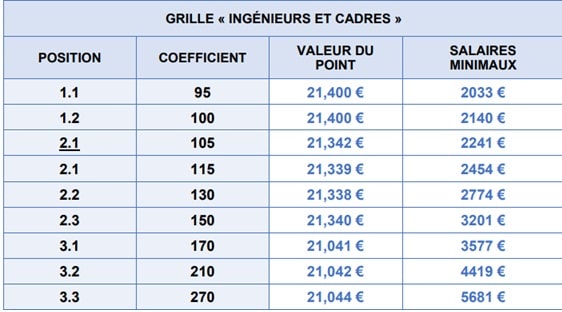

The new salary scale for engineers and managers

The minimum gross monthly salaries applicable to engineers and managers are determined by the following formula:

Position coefficient x Point value

In application of this formula, the values of the gross monthly hierarchical minimum wages have been modified as follows:

| Position | Coefficient | Point value (€) | Minimum wage (€) |

|---|---|---|---|

| 1.1 | 95 | 21,400 | 2 033 |

| 1.2 | 100 | 21,400 | 2 140 |

| 2.1 | 105 | 21,342 | 2 241 |

| 2.1 | 115 | 21,339 | 2 454 |

| 2.2 | 130 | 21,338 | 2 774 |

| 2.3 | 150 | 21,340 | 3 201 |

| 3.1 | 170 | 21,041 | 3 577 |

| 3.2 | 210 | 21,042 | 4 419 |

| 3.3 | 270 | 21,044 | 5 681 |

DESRUMAUX AVOCATS is naturally at the disposal of employers wishing to receive advice and support in connection with this change to the SYNTEC agreement wage scale.